-

Products

-

Solutions

-

Resources

-

Company

- Pricing

Products

Solutions

Resources

Company

Mobile payment application security is a critical part of protecting consumer transactions and ensuring that sensitive payment data does not end up in the hands of malicious actors via reverse-engineering or dynamic attacks.

In 2020, more than 1 billion people worldwide used a mobile payment app to pay in-store at least every six months.

Ssecurity measures can ensure that financial services companies comply with PCI requirements, or the security standards set by the Payments Card Industry to protect consumers, merchants and financial services institutions.

Application hardening with Guardsquare is one way to protect mobile payment apps, making them more difficult for attackers to penetrate.

This is done by layering the following protections:

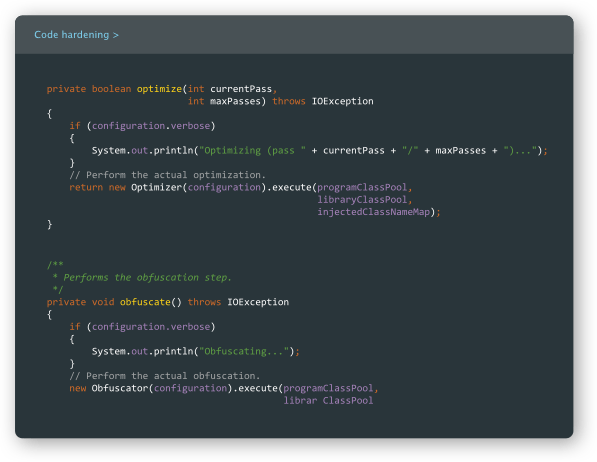

Code hardening protects mobile payment applications and SDKs for Android and iOS from reverse engineering. It consists of hardening the code at various levels through obfuscation and encryption. Hardened code is resistant to both automated and manual analysis.

Runtime application self-protection (RASP) can detect runtime threats such as an application running on a rooted or jailbroken device, an attempt at tampering with an app behavior through hooking, and more. It then triggers the application to react in a pre-programmed way (such as terminating a user session).

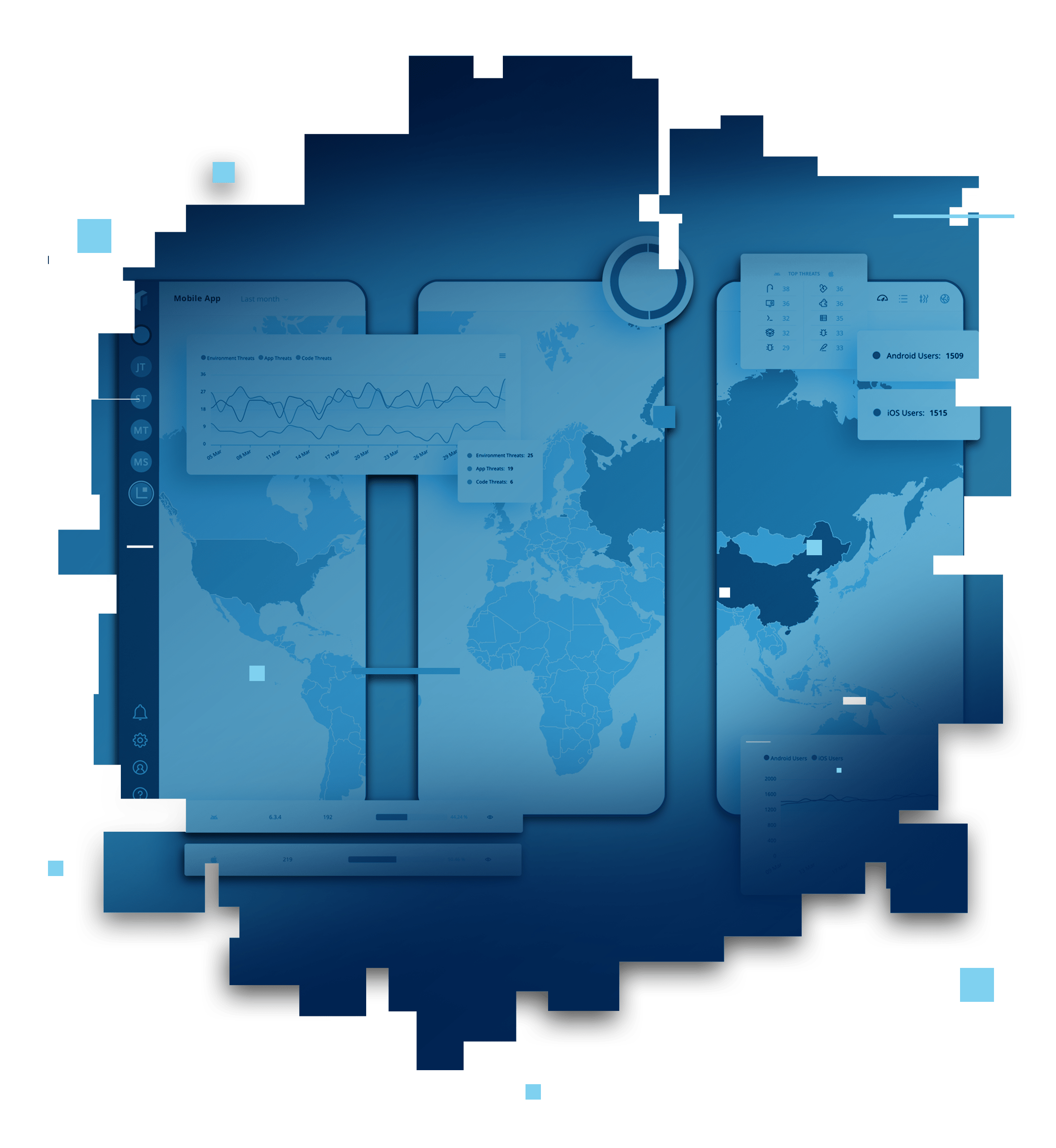

Real-time threat monitoring can detect attacks on downloaded applications as they happen, so you can stop them and shore up your security defenses for future releases.

Code hardening protects mobile payment applications and SDKs for Android and iOS from reverse engineering. It consists of hardening the code at various levels through obfuscation and encryption. Hardened code is resistant to both automated and manual analysis.

Runtime application self-protection (RASP) can detect runtime threats such as an application running on a rooted or jailbroken device, an attempt at tampering with an app behavior through hooking, and more. It then triggers the application to react in a pre-programmed way (such as terminating a user session).

Real-time threat monitoring can detect attacks on downloaded applications as they happen, so you can stop them and shore up your security defenses for future releases.

Guardsquare’s DexGuard and iXGuard solutions help financial services companies achieve PCI compliance for their mobile payment applications. Here’s how.

Guardsquare’s solutions fulfill specific PCI mobile app payment acceptance guidelines such as: